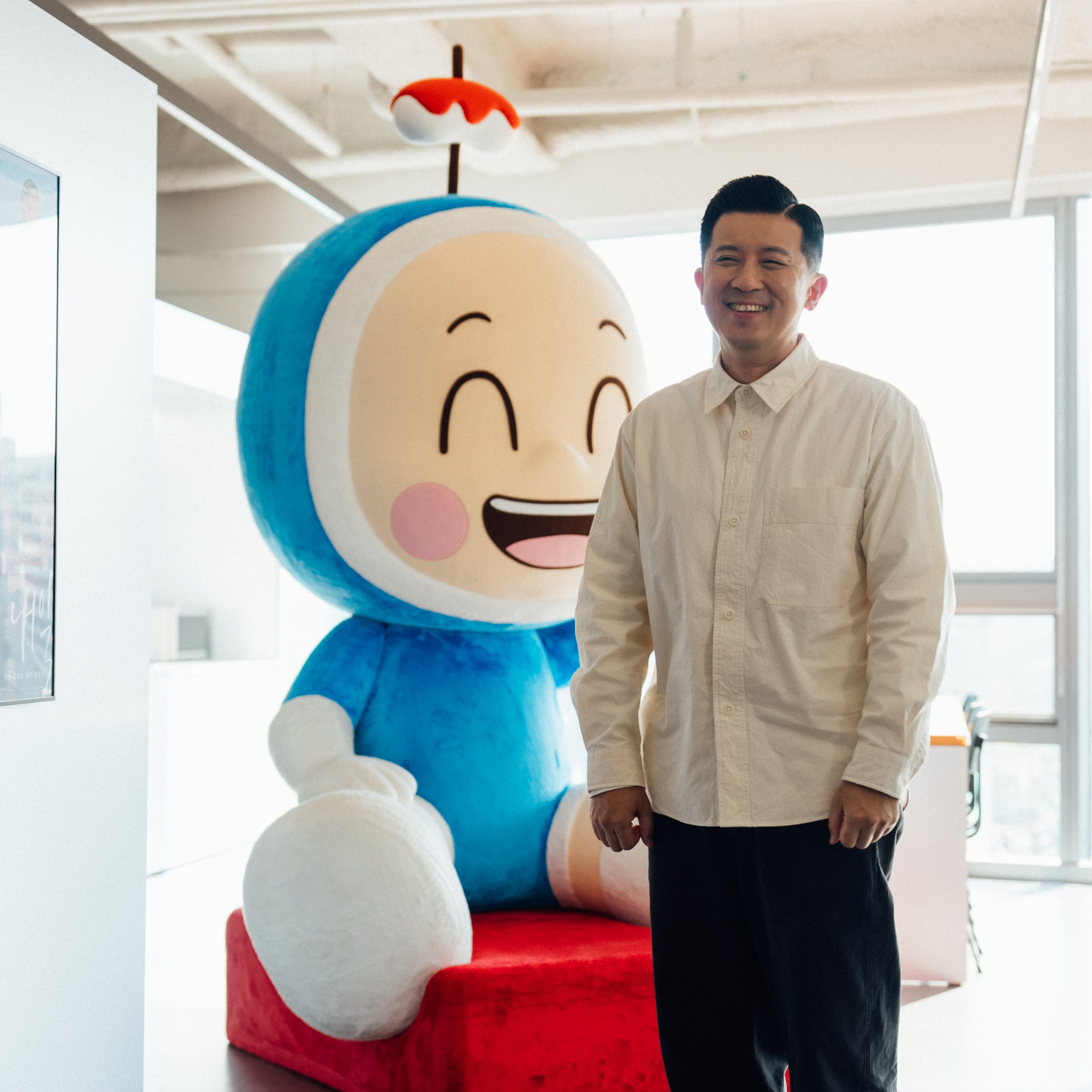

의미 있는 일을 하고 있다는 감각

- 김재홍

- S&B

- Product Development 직무 바로가기

“지금 네이버파이낸셜에서 하는 일은 기존 금융권에서는 할 수 없는 일이에요. 수익보다는 의미를 추구하는 측면이 커요.” 수익을 최우선의 가치이자 미덕으로 여기는 금융권에서, 의미에 무게중심을 둔다는 것은 다소 생소하게 여겨질 법하다. 올해로 경력 12년차인 네이버파이낸셜의 김재홍은 그 격차를 직접 체감하고 있다. 10년간 두 곳의 금융기관에서 신용대출 관리, 상품 손익 분석, 비대면 주택담보대출 상품 기획 등을 진행해 온 그는 2년 전 네이버파이낸셜에 합류하여 ‘소상공인을 위한 대출 상품’을 기획했다. 그는 금융을 통해 사회의 문제를 해결하는 데 기여할 수 있기를 바라고, 그것이 네이버파이낸셜을 선택한 이유라고 말한다.

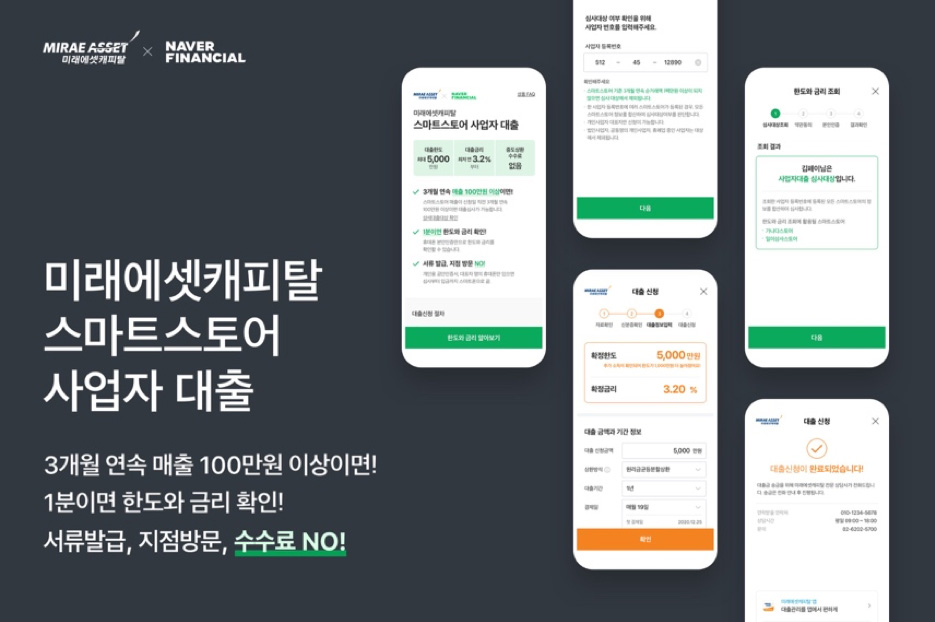

입사하자마자 SME 소상공인을 위한 대출 상품 기획을 맡아서 출시했고요. 출시 이후 고도화하는 작업도 계속 하고 있어요. 스마트스토어 사업자 대출은 온라인에서 사업하시는 개인 사업자 분들을 위한 대출 상품인데요. 일반적으로 온라인에서 사업하시는 분들의 경우 오프라인 점포도 없고 금융 이력도 짧은 젊은 분들이 되게 많아요 그러다 보니까 은행이나 금융권에서 대출이 거절되거나 금리가 높은 경우가 많더라고요. 그런데 그 분들이 스마트스토어에서는 정말 성과를 잘 내고 계신 분들이 많거든요. 그래서 미래에셋 캐피탈을 만나서 네이버파이낸셜이 신용 평가를 위탁받아 수행할 테니 이 부분을 인정해 주셨으면 좋겠다, 라고 협의를 시작했습니다. 처음에 협의를 시작할 때는 사실 굉장히 어려움도 많았었는데요. 금융 기관에서는 시도해 보지 않은 부분, 그리고 검증되지 않은 부분에 대해 도전하는 것을 굉장히 좀 두려워하는 부분이 있었거든요.

네이버에는 금융권에서 사용하지 않는 비금융 정보들이 굉장히 많이 있어요. 예를 들면 상품 판매건수라든가 성장 속도, 반품률, 그리고 거래건수, 리뷰 수 등 스마트스토어 내의 다양한 정보들이 있어요. 저희는 이러한 정보들도 사업자의 신용도를 판단하는 데 활용될 수 있다고 생각을 했어요. 초기 사업자 분들은 증빙할 수 있는 소득 서류가 없어서 아무래도 기존 금융권에서 대출을 받지 못했던 부분도 있었을 텐데요. 저희는 카드 사용 내역을 활용해서 추정 소득을 확인할 수 있었고 이런 정보들이 전반적으로 미래에셋캐피탈에 반영될 수 있도록 계속해서 협의를 진행을 해왔습니다.

그리고 소상공인 분들이 은행 어플로 들어갈 필요 없이 네이버 어플에서 대출의 모든 프로세스가 진행되게 하면 좋겠다는 것이 저희의 입장이었는데요, 시중 은행들은 그렇게 진행해 본 사례가 거의 없었어요. 대출을 하기 위해서는 반드시 그 은행의 어플을 깔아야 하고, 예금 계좌를 만들어야 하는 조건들이 붙어 있어요 그런 부분들을 협의하기가 어려웠죠. 처음 대출을 받을 때 문턱을 낮춰 주는 것이 중요하고, 미래에셋캐피탈 상품이 굉장히 편하구나 그런 인식을 먼저 주자, 이런 식으로 미래에셋캐피탈을 설득했습니다.

온라인 사업자를 대상으로 하는 신용 대출은 최초라고도 할 수 있어요. 다들 두려워서 못 해본 영역이거든요. 가장 뿌듯한 건 승인율이에요. 대출을 신청하고 통과되는 비율인데요, 그 비율이 단연코 높아요. 시중 은행의 경우 승인율이 20%가 넘지 않고, 제2금융권에 가더라도 30%가 채 안 돼요. 그런데 저희는 승인율이 50%에 달하고 있거든요. 두 분 중 한 분은 승인이 된다는 이야기예요. 지금 상품을 출시한 지 1년이 다 되어 가는데요. 현재까지는 연체가 거의 없어요. 이건 기존 금융 상품에 비하면 굉장히 좋은 결과라고 생각되거든요.

“온라인 사업자를 대상으로 하는 신용 대출은 최초라고도 할 수 있어요.

다들 두려워서 시도하지 못한 영역이거든요.”

가장 힘들었던 부분은 아무도 안 해본 일이라는 점인 것 같아요. 제가 입사했을 때 이 프로젝트는 아주 초기 단계였고 그때는 담당자가 저 하나였어요. 초창기에는 특히 비금융정보를 활용하기 위해 스마트스토어 데이터 부서, 휴대폰본인인증 관련 부서, 개발팀 등등 다른 부서와의 협업이 중요했어요. 그 어려움을 이겨낼 수 있었던 건 일반 금융권보다 네이버가 일단 협업에 다들 열려 있어서였어요. 상의하면 다들 친절하게 알려 주시더라고요. 기존 금융권에서라면 할 수 없었던 기획 업무들을 다양하게 할 수 있는 것이 네이버파이낸셜의 장점이기도 해요.

미래에셋 캐피탈이 제2금융권이다 보니까 제1금융권 대출도 추가했으면 좋겠다는 사용자 보이스들이 계속해서 들려왔어요. 그래서 우리은행 제휴도 확대했습니다. 우리은행의 경우 미래에셋 캐피탈처럼 심사를 저희가 대신할 수 있는 방식은 아니지만, 오프라인 사업장이 있어야 한다거나 증빙 가능한 소득이 있어야 한다거나 하는 기존 조건들은 다 없애는 것으로 협의가 되었어요. 그리고 시중의 일반 대출 비교 앱들에서는 정확한 심사가 사실 불가능하거든요. 가심사 하고 계좌 개설을 한 다음에야 진짜 심사가 이루어지는데, 사업자 분들이 시간을 들여서 계좌 개설까지 했는데 나중 가서 대출이 거절되거나 금리와 한도가 달라지는 경우도 굉장히 많아요. 저희는 그런 불편함을 없애고 싶었어요. 네이버 앱에서 거의 확정된 수준의 심사를 제공하자, 나중 가서 거절되지 않도록 보장해 주자. 실제로 저희는 은행 앱까지 설치했을 때 거절되는 케이스는 5% 미만이고 한도나 금리가 달라지는 부분은 전혀 없어요. 바쁜 사업자들에게는 이런 부분도 매우 중요한 부분이라고 생각해요.

저 같은 경우에는 은행 앱이나 다양한 금융기관에 가서 실제로 대출을 많이 받아 봐요. 한도 조회, 신청까지만 하고 끝나는 것이 아니라 실제로 입금되는 절차까지도 한번 다 진행을 해보는데요. 정말 제가 처음부터 끝까지 진행을 해볼 때 관여도가 높기 때문에 불편한 점들을 조금씩 발견을 할 수 있어요. 그리고 사업자 분들을 대상으로 인터뷰도 많이 진행을 하고 있는데요. 제가 세웠던 가설과 사업자 분들의 인터뷰를 종합해서 불편한 부분들을 하나하나 개선해 나가고 있어요.

이전에 있었던 금융 기관에서는 고객 수를 모으거나 수익을 확대하는 부분이 굉장히 중요한 과제였고 그에 대한 압박도 되게 심했던 거 같아요. 지금 네이버 파이낸셜에서 하고 있는 프로젝트는 기존 금융권에서는 할 수 없는 프로젝트들이거든요. 처음 서비스 시작할 때는 수수료 받지 않다가 사용자가 충분히 확보되면 그때 수수료를 부가한다거나 이런 방식들은 많죠. 그런데 저희는 그런 방식도 아니에요. 전체 소상공인 숫자 자체가 크지 않아서 사용자 수를 많이 모으는 것 자체가 불가능하고요. 정말 순수하게 소상공인의 비즈니스를 돕는다는 측면이 커요. 물론 네이버가 이런 서비스를 할 수 있는 건 다른 비즈니스에서 탄탄하게 수익이 발생하고 있기 때문이기도 하고, 소상공인이 잘 되는 것이 곧 네이버가 잘 되는 길이기 때문에 할 수 있는 방식이기도 하죠. 저는 이런 식으로 금융에 접근할 수 있었던 게 되게 좋았고, 이런 프로젝트를 저는 예전부터 좀 하고 싶긴 했었어요.

제가 입사하고 1년 정도는 정말 바쁘게 생활을 해왔거든요.

그런데 상대적으로 덜 바빠지니까 뭔가 공허함이 생기는 거예요.

사실 기획도 그렇고 개발도 그렇고 새로운 업무를 할 때는 굉장히 재미있거든요.

그런데 서비스를 출시하고 운영을 하게 되면 조금 재미가 없어지기도 해요.

자잘한 운영도 많아지고 사람들의 관심에서 멀어지기도 하고요.

계속해서 새로운 기획을 하고 싶다는 생각을 아마 하시게 될 거예요. 그건 저도 마찬가지였고요.

그때 상위 조직장 님께서 말씀해 주셨던 부분이 1년 내내 정말 바쁘게 일만 하고 살 수는 없다, 신문 기사도 읽고 책도 읽으면서 편안하게 마음을 가지고 쉬었으면 좋겠다, 지금 잠시 쉬고 있다가 다음 번에 또 기획을 하게 된다면 그때 한번 달려 줘라.

저는 그 대답이 굉장히 좋았고 그런 말씀을 듣지 못했다면 저 혼자서 버텨 내기는 조금 힘들지 않았을까 이런 생각을 하고 있어요.

아무래도 저뿐만 아니라 모든 기획자들이 고민하고 있는 포인트인 거 같아요.

회사 차원에서도 계속해서 새로운 사업을 추진할 수 있는 부분은 아니거든요.

그래서 저 같은 경우에는 제가 시장을 보면서 어떤 기획을 할 수 있을까, 미리 많이 고민을 해봐요.

스스로 기획서를 많이 만들어서 보고를 하는 편이고요. 근데 기획서를 만든다고 다 진행되는 건 아니에요.

한 10번 만들면 1번이 진행이 될까 말까 에요.

그런데 그렇게 하다 보면 기획할 수 있는 기회가 오히려 더 많아지더라고요.

“슬럼프를 느낄 때는, 스스로 새로운 기획서를 만들어 보기도 해요.

그러다 보면 기획할 수 있는 기회가 많아지더라고요.”

해보고 싶은 일은 많은데 우선은 기존의 금융에서 확인되지 않는 영역에 있는 모든 분들 대상으로 대출을 확대하는 것이 제가 앞으로 해야 할 일들이라고 생각해요. 저희 대출 상품은 현재는 스마트스토어에 가입된 분들만해당되거든요.

사실 금융 쪽에 계신 분들은 누구나 수익성이 높은 비즈니스를 만들고 성과를 내는 것 자체에 의미를 두는 분들이 많고, 저도 당연히 그런 고민을 해요. 네이버파이낸셜에서도 그런 상품도 하자고 계속 말씀드리고 있고, 검토도 하고는 있습니다.

그런데 개인적으로 예전에 비해 돈을 버는 것보다는 사업자 분들의 성공을 지원할 수 있으면 좋겠다는 생각이 조금 더 강해졌어요. 지금 네이버 생태계에 계신 사업자 분들이 굉장히 많거든요 그분들까지 모두 도움을 드릴 수 있는 금융 서비스를 만들고 싶어요. 그분들에 대한 데이터도 부족하고 금융당국도 설득을 해야 되는 부분도 있고 리소스 문제도 있고,

아직은 먼 길이긴 한데 궁극적으로 그런 서비스를 만들고 싶어요.

일이라는 게 담판 승부라면 다양한 능력이 중요하겠지만, 10년 20년이 넘는 꽤 오랜 승부라고 생각해요.

그래서 결국 지치지 않고 포기하지 않는 게 생각보다 중요해요.

긍정적인 사고 방식이 저에게 있어서는 일을 잘 하는 기준이예요.

일을 하다 보면

내 능력이 부족해서, 리소스가 부족해서, 바뀌는 시장이나 규제 때문에, 정말 다양한 장애물들이 있고 포기하고 싶은 순간들이 와요.

그렇지만 거기서 멈추면 아무리 똑똑해도 일을 잘 한다고 할 수는 없죠.

사실은 긍정이라는 게 끈기 하고도 이어지는 것 같아요.

네이버파이낸셜이 수익만 추구하는 게 아니라 의미를 추구하는 일을 할 수 있게 해주는 게 제가 계속 일을 할 수 있는 동력이 된다고 생각하고 있습니다. 그리고 일의 의미를 같이 일하는 동료들에게 계속해서 전달하는 것도 중요하다고 생각을 하고 있어요. 저 같은 경우에는 사업자 분들과의 접점에 있다 보니까 이런 대출 상품을 만들어 줘서 되게 고맙다, 굉장히 상품이 편리하다, 이런 칭찬들을 많이 듣는데요. 그럴 때 정말 앞으로 더 열심히 하고 좋은 서비스를 만들어야겠다 이런 생각들이 많이 들어요. 저 외에도 많은 분들이 운영을 도와주고 계시는데 그 분들에게도 굉장히 의미 있는 일을 하고 있다는 점이 잘 전달되어야 될 거 같아요. 좋은 의미가 동료들에게도 잘 공유되어서 함께 앞으로 나아가는 것이 굉장히 중요하다고 생각하고 있습니다.

Published APR. 2022